Oct 17, 2021 · 4 min read

How Accessory Dwelling Units Can Increase Affordable Housing in Oakland Communities

The new Keys to Equity program focuses on serving homeowners in Oakland who want to build or legalize an ADU on their property.

Far too many Bay Area residents are at risk of displacement. Rising housing costs continue to ravage the community, placing a massive financial strain on many. Homeowner cost burdens have sharply risen in the past few decades, with Black and Latinx homeowners facing the highest cost burden out of all of the racial groups.

A big reason for this is the explicitly discriminatory housing policies ingrained in U.S. history. Exclusionary housing ordinances, redlining, and restrictive covenants were just some of the many policies placed in the 20th century that led to the massive inequities we see in housing today.

The rising cost of living in the Bay Area, stagnating salaries, and the lasting impact of the COVID-19 pandemic on our economy has made it all the more challenging for many homeowners to maintain and upgrade their properties.

Preserving and Producing More Housing with Accessory Dwelling Units

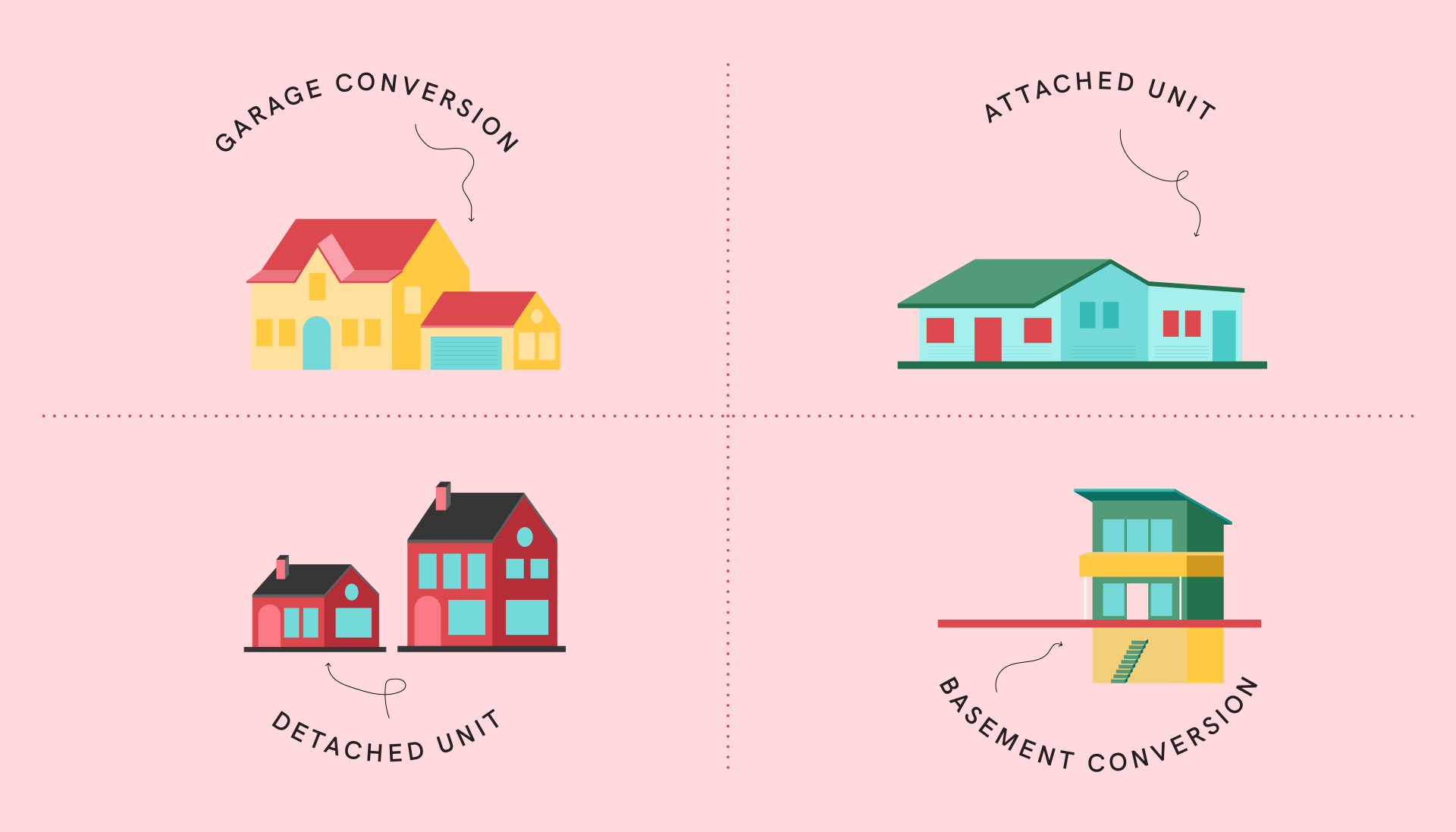

Innovative housing solutions can help prevent greater displacement in regions like the Bay Area. One of these solutions is the building of accessory dwelling units (ADU). An ADU is a residential unit that’s added to an existing home, whether in the form of a garage, a freestanding cottage, or a part of the main house that has been converted into an additional unit. While smaller than a typical unit, there are many benefits to constructing more ADUs.

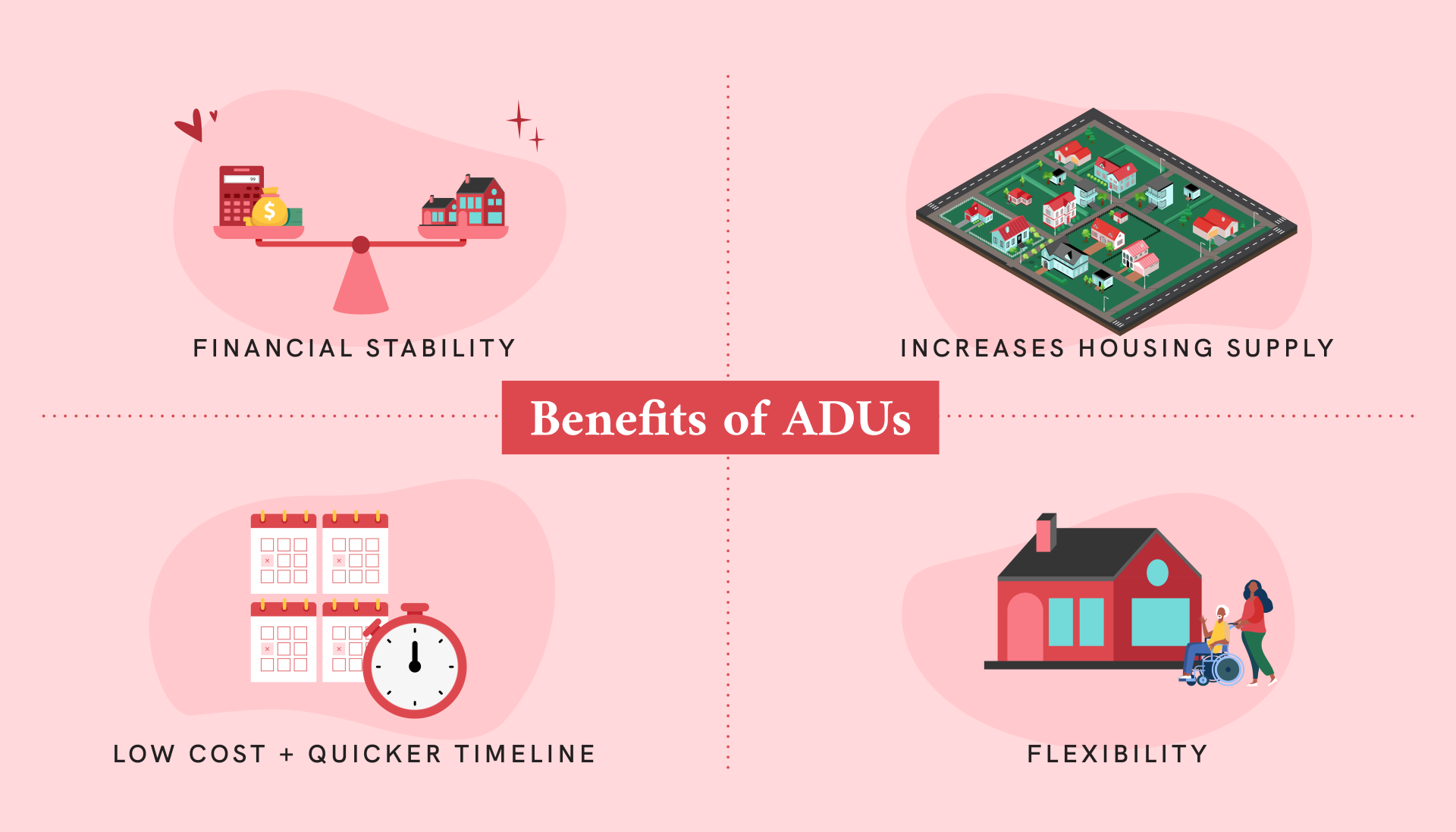

Financial Stability for Homeowners

ADUs with rent-paying tenants can provide additional income for homeowners. ADUs in Oakland, California, are especially important because nearly one-third of homeowners are cost burdened, and this burden is disproportionately faced by people of color. ADUs provide extra income to the homeowners of the single-family unit and the opportunity to boost the household’s wealth.

White families are significantly more likely to own a single-family home and the resources needed to build an ADU onto their property. But, the City of Oakland plans to create targeted policies and programs to ensure that people of color and lower-income households will benefit from ADUs.

Protecting Tenants

In the past decade, there has been a 25% decrease in the Black population of Oakland, and housing prices are one of the most significant drivers of residential movement and forced displacement. Research shows that the average rent of an ADU in Oakland is considered affordable to a single-person household earning 60% of the area median income. Because ADUs are a low-cost way to add more affordable housing into the community, they reduce displacement risks for lower-income residents and stabilize neighborhoods.

Low Cost, Quicker Timeline

ADUs are less costly to build than traditional units, providing local communities with a fast yet sustainable solution to the housing crisis. The average Oakland ADU costs between $175,000 to $263,000, and takes approximately four months to build — which is much less than the average cost of $726,000 per unit for below-market housing in Alameda County, California.

Flexible Housing Options

ADUs are particularly well-suited for couples, small families and seniors. Additionally, they can house the extended families of the homeowners, bringing families together and keeping them close while still maintaining the privacy and space of a separate unit.

Increasing Equity in ADU Access

While still a relatively new idea, ADUs have the potential to prevent the displacement of Oakland residents and strengthen our communities. With these benefits in mind, Richmond Neighborhood Housing Services has partnered with the Chan Zuckerberg Initiative and the City of Oakland to design the Keys to Equity program — an initiative to serve homeowners in Oakland, with a focus on Black households, who want to build or legalize an ADU on their property. The program provides one-on-one guidance through the development process and a suite of benefits for homeowners, including customized ADU architectural designs, lending products, and certain subsidies for eligible homeowners in order to make ADUs more accessible to households that have been systematically excluded.

Learn more about the Keys to Equity program on its website.